tax free louis vuitton | louis vuitton france vat refund tax free louis vuitton One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers. First find the Spirit you want to Enhance, below the name of the Spirit you will see it’s Level, power meter, and a tab that says “Can Be Enhanced at Lv.99”.

0 · tax free louis vuitton lisboa

1 · louis vuitton tax refund uk

2 · louis vuitton tax refund

3 · louis vuitton tax free japan

4 · louis vuitton shopping tax refund

5 · louis vuitton online return

6 · louis vuitton france vat refund

7 · gucci vat refund italy

60. 690 views 1 year ago. Louis Vuitton experts: I need your help! Have you ever seen a red Louis Vuitton dust bag like that before? I found this LV one at the flea market, it looks and feels.

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in . One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on .

At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. At the Departure Airport: Take your passport, refund forms, receipts and purchases to a customs official for verification. In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .

One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers. The Pros of Buying Louis Vuitton at the Airport. Tax-Free Shopping. If you are traveling internationally, you can take advantage of tax-free shopping at many airports. This means that you can save up to 20% on your purchase. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family. The United States allows 0 per person of duty-free goods. If you travel with a family of four, that’s ,200 collectively of U.S. tax–free import.Guide to shopping Chanel, Louis Vuitton, Celine, Dior, Hermes and other brands tax-free at airports.

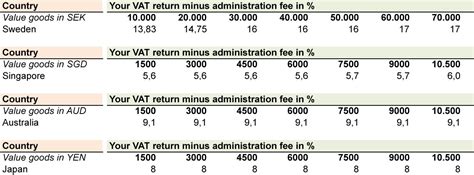

But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT percentage amounts for several countries, along with the VAT amount you’ll receive after paying administration fees.

For international purchases with tax-free claims, the item can be exchanged for an item of same retail price or refunded for store credit for full amount without tax. When exchanging for an item, the difference between tax-free price and UK retail price must be paid to Louis Vuitton.

When you're at Louis Vuitton's checkout with your dream bag, tell the Sales Assistant that you would like to get a VAT refund. They will ask for your data and either fill in the documents straight away, or they will give you the Tax Free form with an envelope, filling in all the information they have to provide.LOUIS VUITTON Official USA site - Shop designer scarves for women that reflect high quality & craftsmanship. Discover silk scarves, bandeaus & squares. At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. At the Departure Airport: Take your passport, refund forms, receipts and purchases to a customs official for verification. In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .

One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers. The Pros of Buying Louis Vuitton at the Airport. Tax-Free Shopping. If you are traveling internationally, you can take advantage of tax-free shopping at many airports. This means that you can save up to 20% on your purchase. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family. The United States allows 0 per person of duty-free goods. If you travel with a family of four, that’s ,200 collectively of U.S. tax–free import.Guide to shopping Chanel, Louis Vuitton, Celine, Dior, Hermes and other brands tax-free at airports.

But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT percentage amounts for several countries, along with the VAT amount you’ll receive after paying administration fees.For international purchases with tax-free claims, the item can be exchanged for an item of same retail price or refunded for store credit for full amount without tax. When exchanging for an item, the difference between tax-free price and UK retail price must be paid to Louis Vuitton. When you're at Louis Vuitton's checkout with your dream bag, tell the Sales Assistant that you would like to get a VAT refund. They will ask for your data and either fill in the documents straight away, or they will give you the Tax Free form with an envelope, filling in all the information they have to provide.

tax free louis vuitton lisboa

louis vuitton tax refund uk

louis vuitton tax refund

louis vuitton tax free japan

louis vuitton shopping tax refund

Louis Vuitton Damier Ebene Caissa Hobo Bag. $1,799.99. Color: BROWN. Size: One Size. Only 1 Left! Condition: Very Good. Add to Bag. This item is final sale and non-returnable. Sourced & Shipped by Two Authenticators | Final Sale. Ship it to 23917. Pick up at. Choose a Store. 0 viewing.

tax free louis vuitton|louis vuitton france vat refund